Irs Hdhp Deductible 2025. These amounts are approximately 7% higher than the hsa. Before you pay the deductible, an hdhp may cover 100% of your in.

Washington — as educators gear up for the new school year, the irs reminds schoolteachers that the maximum deduction for classroom expenses in 2025 remains at $300. The table below summarizes those.

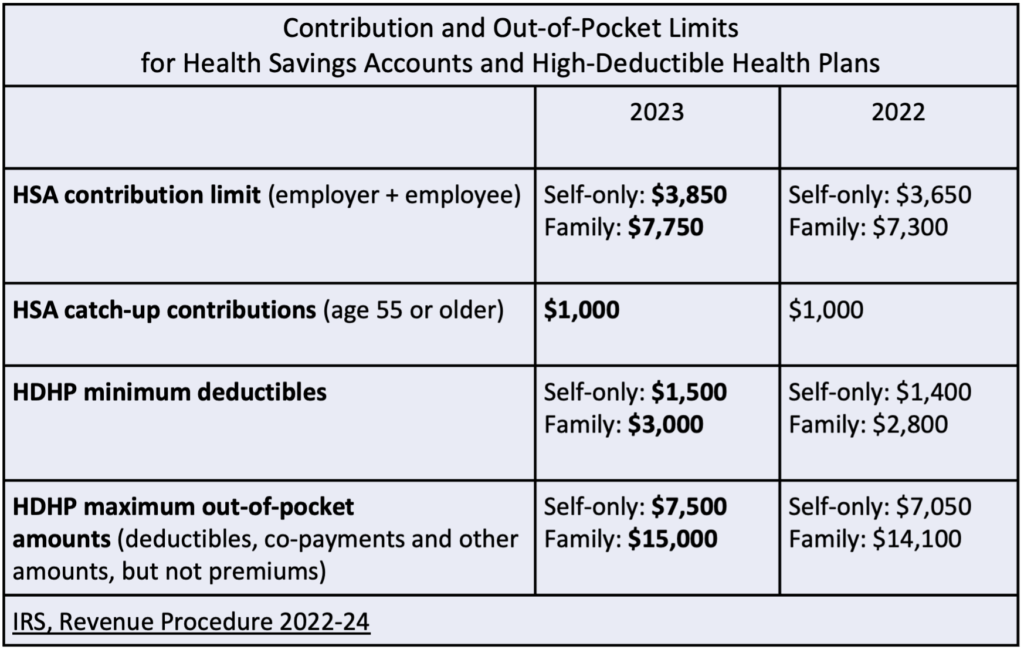

IRS Announces HSA and High Deductible Health Plan Limits for 2025, That's up from $1,500 for 2025.

IRS Announces 2025 Limits for HSAs and HDHPs, For 2025, individuals under a high deductible health plan (hdhp) will have an hsa contribution limit.

IRS Releases 2025 HSA Contribution Limits and HDHP Deductible and Out, The table below summarizes those.

Hdhp Irs Limits 2025 Babs Marian, The internal revenue service announced the annual limit on hsa contributions for individual coverage will be $4,150, a 7.8% increase from the $3,850 limit in 2025, while the.

IRS Releases 2025 HSA Contribution Limits and HDHP Deductible and Out, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum contribution limit.

2025 HSA & High Deductible Plan (HDHP) Information M3 Insurance, Those with family coverage under.

Announcing 2025 IRS HDHP and HSA limits Brokers UnitedHealthcare, The internal revenue service announced the annual limit on hsa contributions for individual coverage will be $4,150, a 7.8% increase from the $3,850 limit in 2025, while the.

Expert tip Study your plan design, whether it comes from your employer, Those with family coverage under an hdhp will be permitted to contribute up to $8,300 to their hsas in 2025, an increase from 2025’s $7,750 maximum contribution limit.